Print and Post your mail directly from your desktop with a click of you mouse. Our hybrid mail solution allows customers to send a single letter for as little as 84p.

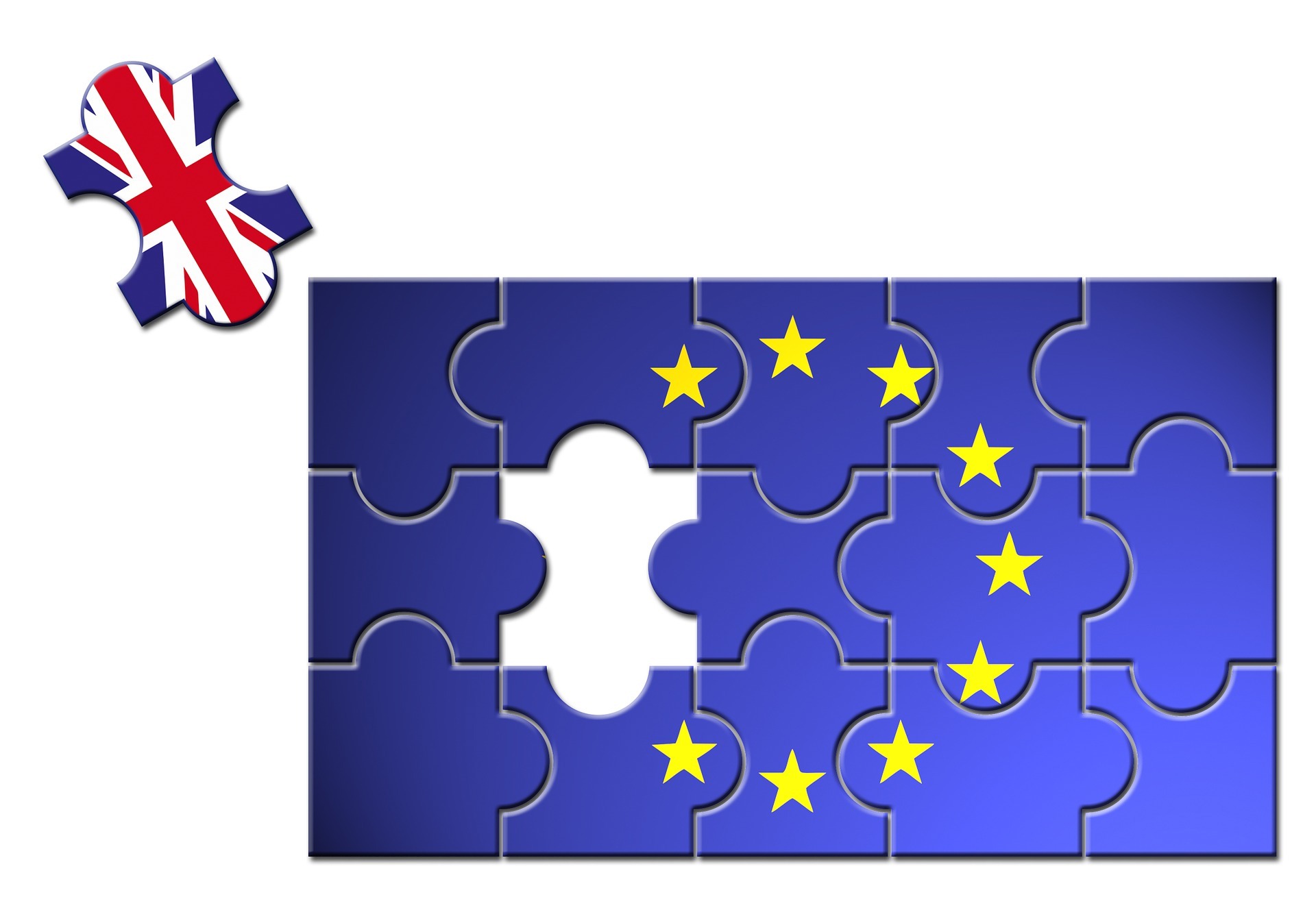

what does brexit mean?

This simple answer is we don’t really know what will happen. We have to assume Brexit will go ahead in the next year, or so, whenever Article 50 is invoked.

In terms of Hybrid mail Solutions situation and posting into Ireland. The ability for us to remove international postage is key to our business and what’s more the ability to manage our Ireland customers is imperative and to be able to post into Ireland. We are located on the border in the UK and 7 miles up the road you are in the Republic of Ireland or as some say now in the EU and we are Non EU.

There has always being open borders in Ireland since 1920. There has always been free travel and movement, even throughout the troubles. However, during the troubles there were army checkpoints and customs but there was still free travel and movement of goods, with no tariffs or customs duty applied at the borders. Along the border region, at worst case scenario, it is hoped that this will be the same again. Ireland and UK/NI are each other’s biggest customers and suppliers. It is in the best interest of both to maintain their close working relationship.

Coming from Northern Ireland, you are in an unusual position or have the best of both worlds so to speak in that we can have dual citizenship. In Northern Ireland you have the option of having an Irish or a British passport. Effectively, this means in Northern Ireland you can be a European and Non-European citizen.

what are we doing to deal with barriers should they are rise?

The majority of our business comes from Ireland. We print and mail into Ireland daily. It is imperative for us that trade and post into Ireland has no barriers or issues. However, should a situation where barriers and tariffs arise, our location means we can easily open an additional office or print facility in the Republic of Ireland. This facility would be less than 10 miles from our current office and would be in the EU. This gives us competitive advantage whichever way you take it. With a premises already earmarked that can be operational in 4-6 weeks, if required; we have a strong contingency in place. For our Irish customers, it means business continues as normal; except they will be charged VAT which we exempt them from now as we are UK registered.

Basically we have it covered off no matter what way it goes as it critical that we can supply both our UK and Ireland clients (or EU and Non EU as everyone is referring too).